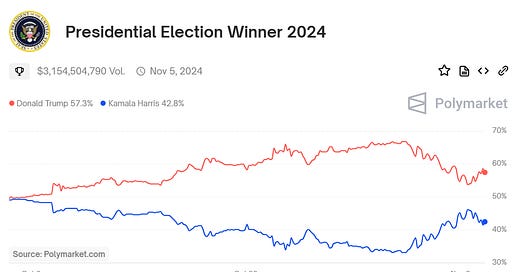

With one day until the 2024 United States presidential election, all eyes are on who Americans will choose as their next leader. While polls have consistently indicated this will be a close election, prediction markets have shown a more volatile story, starting after President Trump’s rally in Butler, Pennsylvania, on October 6.

Since my original post on October 18, I have closely tracked flows into Polymarket, trying to determine whether someone has amassed a substantial position on Trump winning both the presidential election and the popular vote. I have concluded that this is indeed the case, and it may very well be the largest political bet in history.

Mainstream media outlets have written about this mysterious buyer, his position, and his intentions. A Wall Street Journal reporter even spoke to him and revealed further details. However, I believe this trader was not entirely truthful to the reporter. Below, I explain why.

How Big Is This Trader’s Position?

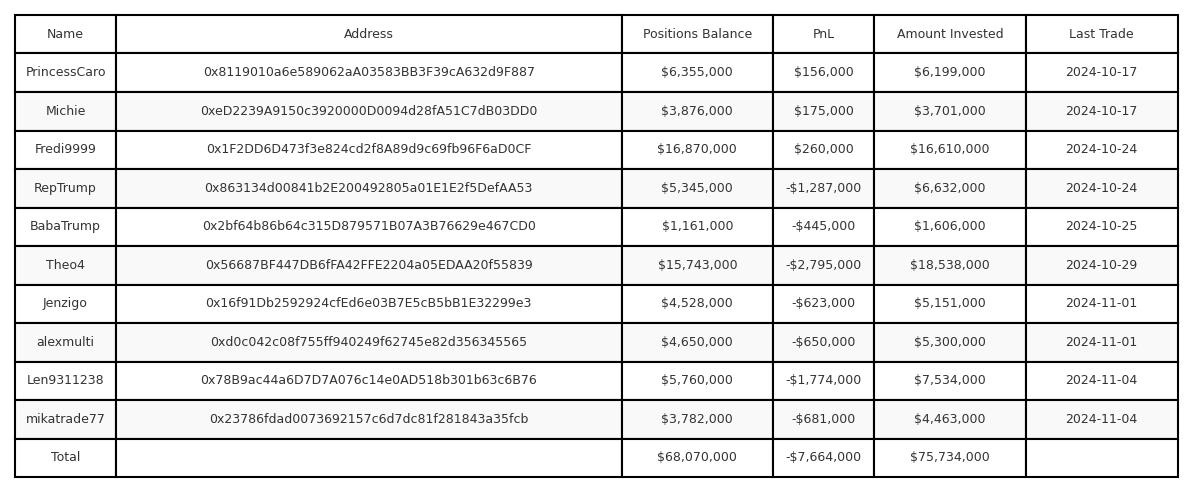

The trader, who asked to be called Theo, revealed that he controls four accounts on Polymarket and has placed bets of roughly $40 million USDC on Trump winning the election, the popular vote, and a few smaller markets. In my research, I identified a total of 10 accounts associated with this trader, and the amount bet appears closer to $75 million. All the accounts I identified share the following characteristics:

With the exception of the original Fredi9999 account, all other accounts were created in late September or October.

All accounts were funded from Kraken, a centralized exchange.

The deposits followed similar patterns: most deposits were either $500,000 or $1,000,000, made at specific times of the day.

Except for brief activity on the night of Sunday, October 20, all accounts were inactive over weekends.

The accounts placed bets on similar markets: presidential election winner, popular vote winner, winners of Pennsylvania and Michigan, and some parlay markets like presidential winner + popular vote winner.

The accounts placed bets in two ways: (1) limit orders matching five-figure orders in the book, and (2) limit orders slightly outside the bid-ask spread to set a large floor on the market.

Based on these patterns, I am highly confident that Theo is associated with these accounts.

Why Would Theo Lie About His Position?

Theo told the Wall Street Journal reporter that he didn’t want anyone to know the extent of his bets on these markets. He also mentioned creating three additional accounts after realizing that the market was reluctant to trade against the original Fredi9999 account. The remaining six accounts were reportedly created after the market and media started focusing on these initial four accounts. I believe Theo wanted to keep increasing his position without drawing attention from the market.

What Is Theo’s Intention?

Theo stated to the WSJ reporter that this was simply a bet on Donald Trump firmly winning the 2024 United States Election. He also claimed he was betting the majority of his liquid assets, though this claim is questionable. My guess is that something was lost in translation; actifs liquides in French can also mean cash or cash equivalents. Perhaps he meant he had placed most of his available cash in these markets. Betting his entire liquid assets on a few illiquid, binary option markets would defy conventional financial wisdom.

Before the WSJ article, I suspected Theo was likely an entity engaging in either a speculative trade of a Trump victory or a hedge against a position expected to suffer if Trump won. Financial markets have shown strong reactions in anticipation of a Trump victory. U.S. Treasuries maturing in five years or more have been volatile, and the U.S. dollar has strengthened significantly against other currencies. I considered that a European commodity firm might be placing these bets in anticipation of oil prices dropping if Trump won, as he has expressed support for increased US oil production and has taken a more favorable stance toward Russia—both potential catalysts for lower oil prices in the near term. After the WSJ came out, it was somewhat confirmed that Theo is a very wealthy ex financial professional placing a large speculative trade1.

Did Theo’s Trades Distort the Market?

Theo’s trades have undeniably influenced the election betting markets on Polymarket. Up until October 30, Polymarket was trading 7-10% more in favor of Trump than other markets. However, on October 30, the market began correcting these prices, despite Theo placing over $8 million in Trump bets between October 30 and November 1. This correction continued over the weekend, and as of noon on November 4, the odds on Polymarket stood at 57% for Trump and 43% for Kamala.

Why Didn’t the Polymarket Odds Correct Sooner?

As Theo’s legend spread through social and mainstream media, many market participants began following these trades closely. Between October 8 and November 1, it wasn’t hard to observe that a series of accounts were placing an average of $2-3 million USDC worth of Trump bets each business day. Many Polymarket traders waited as Theo’s activity continued moving the market in Trump’s favor. As election day neared, the market finally began to align more closely with general sentiment.

Conclusion

Theo will go down in history among election bettors as either the greatest winner or the greatest loser in the 2024 U.S. presidential election. My biggest takeaway from this situation is that we are witnessing unprecedented levels of volume, open interest, and trade sizes, likely catching the attention of major investment firms. I believe we may be entering an era where prediction markets evolve from niche platforms for individual bets into significant markets for financial institutions to make trades, create hedges, and place speculative positions on political and other events impacting financial instruments.

Update: While writing this article, Theo’s accounts deposited an additional $1.5 million USDC into Polymarket, gradually buying Trump to win both the presidential election and the popular vote.

Disclaimer: I trade on Polymarket as a hobby.

I still have my doubts that this is only one individual placing all these trades. Since the beginning, I have always felt it was a group of people working together to amass a large position on Trump.

>I believe we may be entering an era where prediction markets evolve from niche platforms for individual bets into significant markets for financial institutions to make trades, create hedges, and place speculative positions on political and other events impacting financial instruments.

This is the biggest takeaway. Theo's position might seem large now, but it will be laughably small compared to 2028 volumes.